The content battle has just got messy with Sirius XM investors slamming the A$4.8 billion acquisition of Pandora who are now worth more than Spotify.

Shortly after the deal was announced Sirius suffered its worst stock plunge in more than seven years as the US satellite-radio broadcaster moved to take on Spotify in a global market.

On a conference call with analysts, Pandora and Sirius offered little detail about how they would work together after the merger. Sirius Chief Executive Officer Jim Meyer spoke vaguely about “optimizing cross-promotion” between platforms. “My gut tells me — that’s where I see the biggest opportunity,” he said.

Sirius, backed by billionaire John Malone, is betting it can expand beyond an audience that mainly listens to radio while driving.

Sirius bought a stake in Pandora last year for $480 million, after Spotify began luring away streaming-music subscribers.

Sirius fell 10 percent to $6.26, the worst one-day performance since August 2011. Pandora shares also declined, falling 1.2 percent to $8.98 in New York.

Bloomberg said that Sirius is buying a company that has recorded years of losses. Pandora’s shares fell for years in the face of competition from Spotify and other online services.

But a comeback has been in the works.

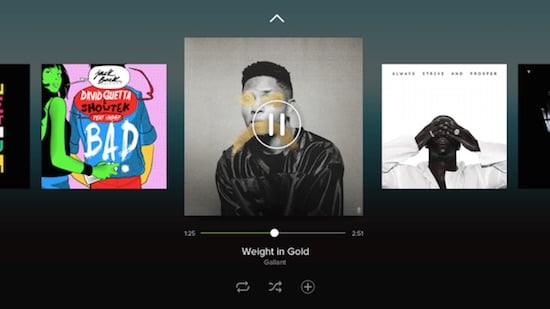

Pandora introduced its own on-demand music service and brought in former Sling TV CEO Roger Lynch a year ago to work on a turnaround. At the end of the second quarter, the company had about 6 million paying customers. That’s helped the stock recover this year, gaining 89 percent as of last week.